This blog post was first published by the Center for Global Development on 19 November, 2024

Last month, Philip Morris International (PMI), the largest global tobacco company by market capitalization, posted bumper third quarter 2024 results. Similarly, Altria, another of the world’s largest producers of tobacco and cigarettes, posted unexpectedly robust financial results for Q3 2024, with quarterly profits of $2.9 billion. A new CGD note published today explores the financial performance of big tobacco companies, alongside alcohol and sugar-sweetened beverage (SSB) industries, during and after the COVID-19 pandemic; we find that financial results have been strong, especially for tobacco companies, and that the argument to raise excise taxes on these products is just as valid now as it was before the pandemic.

During the pandemic, companies resisted tax increases

During the COVID-19 pandemic in 2020, countries faced a dilemma. On the one hand, they urgently needed to raise revenue to pay for healthcare and other vital services. On the other hand, individuals and companies were struggling and called for tax breaks and other support measures.

Health taxes on tobacco, alcohol, and SSBs could have been a way for governments to simultaneously raise revenue and improve health, reducing the burden on over-strained healthcare services. However, the industries behind these products fiercely pushed back, claiming they needed government support in the form of postponed or lowered tax payments in order to weather the pandemic. They further argued that increased taxes would raise costs for consumers in an era of rising inflation, encourage illicit product consumption, and cut employment.

Alas, industry arguments countering tax rises seem to have been heeded. In the years since the pandemic, tobacco tax increases have stalled, with the average tax share of cigarette retail price increasing only marginally from 41.4 percent in 2020 to 42 percent in 2022. The number of countries reporting using alcohol taxes has decreased, and while there has been a substantial increase in the number of countries taxing SSBs, the rates are far lower than evidence suggests they ought to be.

In our new note, we use Euromonitor data for 99 countries and financial reports for large tobacco, alcohol, and SSB firms listed in the United States, to ask, “was this protection of industry interests really necessary?” While we know many industries suffered during the pandemic, did this trend hold for tobacco, alcohol, and SSB companies?

Our findings emphasize that arguments for raising health taxes to curb consumption remain just as valid now as they were before the pandemic. We find that the generally adverse impact of the pandemic on company profits did not hold for tobacco companies and was merely temporary for alcohol and SSB companies.

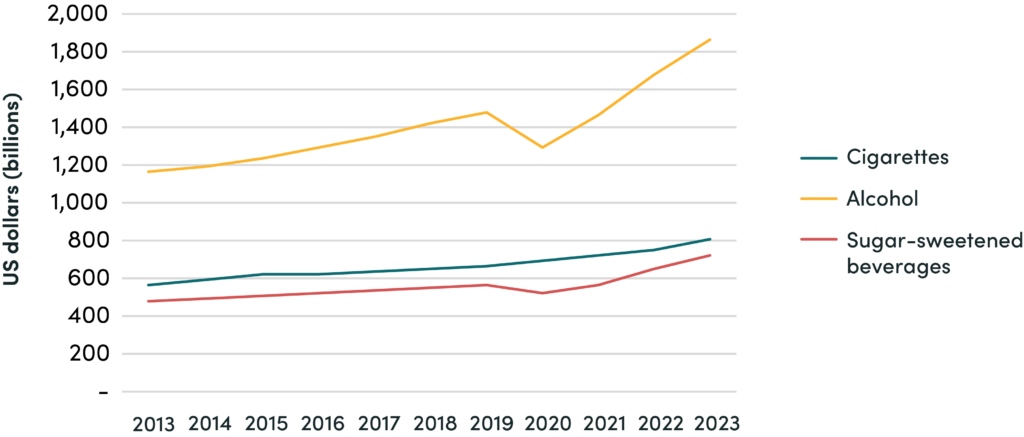

Figure 1: Global sales value of cigarettes, alcohol, and sugar-sweetened beverages, 2013–23

Data Source: Euromonitor

For four large multinational tobacco companies (PMI, Altria, British American Tobacco, and Imperial Brands), we confirm that sales revenues held up during the pandemic (US$106 billion in 2020 compared to US$104 billion in 2019); gross profit margins increased; and gross profits and net profits (adjusted for special factors) were maintained. This is despite the fact that the global sales volume of cigarettes has been slowly decreasing for many years—in other words, volume decreases were offset by price increases, reflecting tobacco companies’ strong control of pricing and the price inelasticity of demand during the pandemic.

Ever-increasing profits post-pandemic

Over four-years on from the start of the pandemic, these industries have rebounded stronger than ever, as clearly shown by recent Big Tobacco earnings. After their strong third quarter 2024 results, PMI now forecasts a fourth consecutive year of sales volume growth since the start of the pandemic in 2020. On the back of higher pre-tax prices, including for its largest sales category (Marlboro cigarettes), and higher sales volumes, it raised its profits estimate for 2024 substantially. Altria’s unexpectedly strong results for Q3 2024 resulted in an ~8 percent increase in its share price on the day of results release. While Altria cigarette sales did drop in the US, they still posted quarterly profits of $2.9 billion, boosted by price increases and share buybacks. And China Tobacco reported an incredible $210 billion revenue in 2023, up 4.3 percent from the previous year.

Clearly, health taxes—an effective policy tool to make these products less affordable and drive reductions in consumption—have lagged during and after the pandemic. In the face of this challenge, the Task Force on Fiscal Policy for Health, co-chaired by Mike Bloomberg, Mia Amor Mottley, and Larry Summers, reconvened this year to provide recommendations for countries and international organizations. The report, released in September, found that all countries should significantly and regularly increase health taxes above the level of inflation, and improve their design, giving the highest priority to tobacco taxes. While many high-income countries may be (deservedly) proud of themselves for levying relatively high health tax rates, there is still room for improvement, and they cannot sit idly by as companies headquartered in their countries continue to make billions of dollars of profit through the sale of health-harming products in low- and middle-income countries. All countries must work together to share lessons of successful implementation, including how to counter industry resistance, and support others to increase and effectively design health taxes.

DISCLAIMER

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.