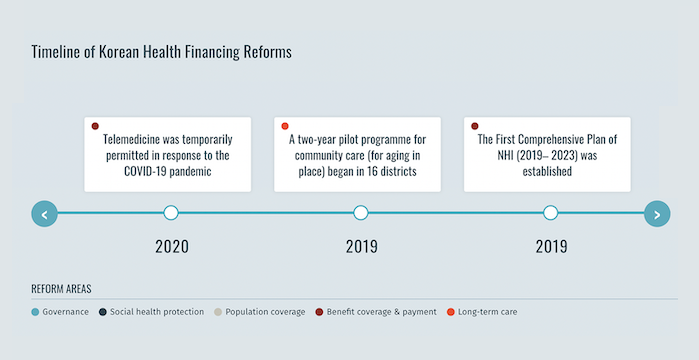

The Republic of Korea met its universal health coverage targets in 1989, just 12 years after the government introduced mandatory National Health Insurance (NHI) in 1977.[1] During this period, NHI membership was incrementally expanded to the entire population beginning with businesses with 500 or more employees. In addition, the Medical Aid Program (MAP), a tax funded assistance programme for the poor established in 1979, remains in place as of 2024. In 2000, previously decentralized insurance schemes were merged into a single-payer system with two quasi-public organizations – the National Health Insurance Service, which collects premiums and reimburses providers, and the Health Insurance Review and Assessment Service, which reviews claims and provides quality assurance.[2] Although the health system achieves health outcomes that exceed the Organisation for Economic Co-operation and Development average, the degree of financial protection remains a concern given the high burden of out-of-pocket expenses in the Republic of Korea. In 2019, the country’s government implemented an NHI reform under the Comprehensive National Health Insurance Plan (2019-2023) to expand the coverage ratio of the NHI to 70% of medical expenses by 2023.

Proactive adoption of universal long term care insurance

Readiness for social health protection during the COVID-19 pandemic

Before the COVID-19 pandemic, the Republic of Korea experienced an outbreak of Middle East Respiratory Syndrome. Following this outbreak, legislative and regulatory reforms strengthened the country’s public health emergency preparedness and response systems. Therefore, when the COVID-19 pandemic hit the country, the NHI rapidly responded. The NHI included COVID-19 related testing and medicines in the benefit package and adopted emergency relief measures. These measures included discounting the NHI contribution for individuals heavily affected by COVID-19 and providing relief funds to individuals and businesses. The NHI ensured people’s access to testing and treatment without financial barrier, in line with the Republic of Korea’s universal health coverage for its entire population.[5]

References

- Extending Social Health Protection: Accelerating Progress towards Universal Health Coverage in Asia and the Pacific. International Labour Organization, 2021

- Kwon, Soonman, et al. Republic of Korea: Health System Review. 5:4, World Health Organization, 2015

- Kim, Hongsoo, and Soonman Kwon. “A Decade of Public Long-Term Care Insurance in South Korea: Policy Lessons for Aging Countries”. Health Policy, vol. 125, no. 1, Jan. 2021, pp. 22–26. ScienceDirect

- Government of Korea, Ministry of Health and Welfare press release. 2023. Accessed 8 Apr. 2024

- Kwon, Soonman, et al. “Republic of Korea’s COVID-19 Preparedness and Response”. World Bank Group Korea Office Innovation and Technology Note Series, no. 3, 2020