Health Financing Progress Matrix – Maldives 2025

The Maldives has made major progress toward Universal Health Coverage (UHC) through expanded public health financing and the establishment of Aasandha, a national insurance program covering both public and private providers. However, the health financing system has...

Decree no. 2025 – 672 of October 29, 2025 on the implementation of compulsory health insurance in the Republic of Benin

Benin's Decree no. 2025-672 of October 29, 2025 updates the terms and conditions of compulsory health insurance, extending state coverage to children in care centers, beggars and the mentally ill, reorganizing the basic basket of care with new conditions and...

IMF Country Report No. 25/261- Guatemala Selected Issues

IMF staff prepared this background paper based on information available up to July 2025. It includes sections on Trends in Health Spending and Outcomes since 2005, Benchmarking of Health Spending, Financing and Outcomes and Health Budget Composition and PHC Spending...

Reality of Reform: Assessing El Salvador’s 2009 Health Reforms and the Future of Health Under Bukele

This 2025 publication from the Princeton University Library, explores El Salvador’s 2009 Health Reforms. The author posits that despite good intentions, results were disappointing, in part due to lack financing.

Tracking universal health coverage: 2025 global monitoring report

Universal health coverage (UHC) is central to the global commitment to ensure that all people can access quality health services without financial hardship, as articulated in the Sustainable Development Goals (SDGs) with a target date of 2030. As this deadline...

APEC advances collaborative agenda to close women’s health financing gaps

APEC economies are strengthening cross-sector collaboration to close women’s health financing gaps, shaping a new regional framework to expand access to essential services through innovative financing.APEC economies are intensifying efforts to address persistent...

African nations turn to health taxes as aid declines

With shrinking aid, African nations are adopting taxes on tobacco, alcohol, and sugary drinks to fund health systems and fight non-communicable diseases. Experts at a regional forum highlighted the promise and pitfalls of health taxes, urging transparent,...

Raising Taxes on Tobacco, Alcohol, and SSBs Could Boost China’s Health and Economy

Rising NCDs in China driven by tobacco, alcohol, and sugary drinks underscore the need for stronger health taxes. New modelling shows a 20% price hike could yield major health and economic benefits. Evidence supports phased, product-specific tax reforms, complemented...

Partnership enhances Africa’s health accounts to advance UHC

WHO and STATAFRIC are collaborating to improve how African countries track health spending and financial protection. Through regional workshops and shared data standards, the initiative builds capacity to generate reliable health statistics that inform policy, promote...

Better investments to accelerate disease elimination in the Americas

This document from the Pan American Health Organization, published at the end of 2025, brings together recommendations for cost-effective investments for 30 public health challenges in the Latin American region.Also available in English

Avoidable pitfalls on the path to health financing self-reliance in low-income and middle-income countries

Published by BMJ Global Health, a journal of the BMJ Publishing Group, the commentary examines the policy risks facing health systems as external donor funding declines. Authored by Edwine Barasa, Jane Chuma, Justice Nonvignon, and Olusoji O. Adeyi, the article...

G20 endorses the Lusaka agenda for global health reform

The G20’s reference to the Lusaka Agenda signals growing global momentum for integrated, country-led health systems, but sustained action and investment are urgently needed, say Stine Håheim & Usman Mushtaq in Health Policy Watch.Health Policy Watch reports that...

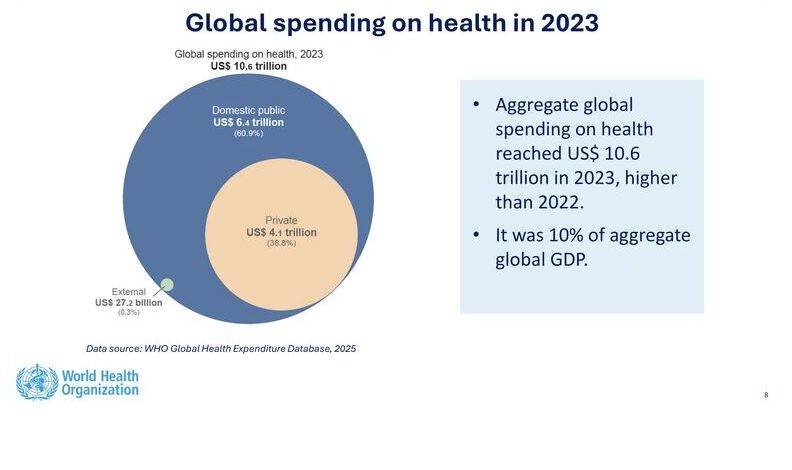

WHO releases 2025 update of the global health expenditure database

WHO has released updated health expenditure data for 190+ countries, including new visual dashboards and technical resources, covering spending trends from 2000–2023.The World Health Organization has officially launched the 2025 update of the Global Health Expenditure...

Senator Questions PhilHealth’s Fund Management Amid Delayed Benefit Rollouts

Senator Bong Go criticized PhilHealth’s handling of funds, citing its ₱60-billion treasury transfer in 2024 and rejection of a ₱70-billion subsidy in 2025 as setbacks to Universal Health Care implementation. He blamed delayed benefit rollouts for unused funds and...

Kenya Boosts Cancer Coverage and Advances Universal Health Reforms

President Ruto announced expanded cancer coverage and key UHC reforms, including improved medicine supply and a new hospital equipment model. The government now insures 2.3 million vulnerable citizens, with goals to enhance efficiency, quality, and equity in...