Sanjeev Gupta and Joao Jalles highlight how health taxes can save lives, curb harmful consumption, and unlock vast untapped revenues for stronger, fairer health systems

A Center for Global Development blog by Sanjeev Gupta and Joao Jalles explores how health taxes can deliver what they call a “dual dividend”: improving population health while strengthening public finances. Noncommunicable diseases (NCDs) now cause more than 70% of global deaths, much of it linked to preventable behaviours like smoking, alcohol use, and sugary diets. Excise taxes on these products, the authors argue, are a powerful tool to reduce harm and expand fiscal space.

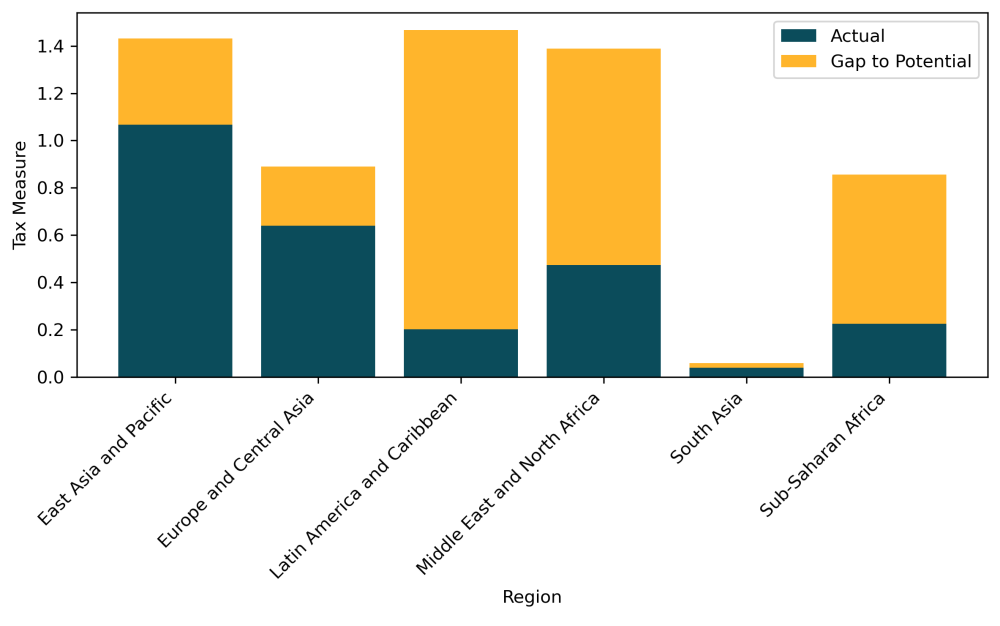

Drawing on benchmarking research across 97 countries, the blog finds that governments are capturing only a fraction of the potential revenue from health taxes. For instance, tobacco excise collections average just 0.4% of GDP, compared to a feasible 1.5%. Sugary drink taxes show the widest gap, with most countries collecting under 15% of what is achievable. These shortfalls highlight the scale of untapped resources that could support universal health coverage.

Gupta and Jalles emphasise that success depends on well-designed and effectively enforced tax systems. They recommend raising rates where feasible, simplifying structures to reduce evasion, and investing in administrative capacity. As experiences in Mexico, Ethiopia, and Colombia show, health taxes—if politically supported—can save lives while ensuring more sustainable financing for health.