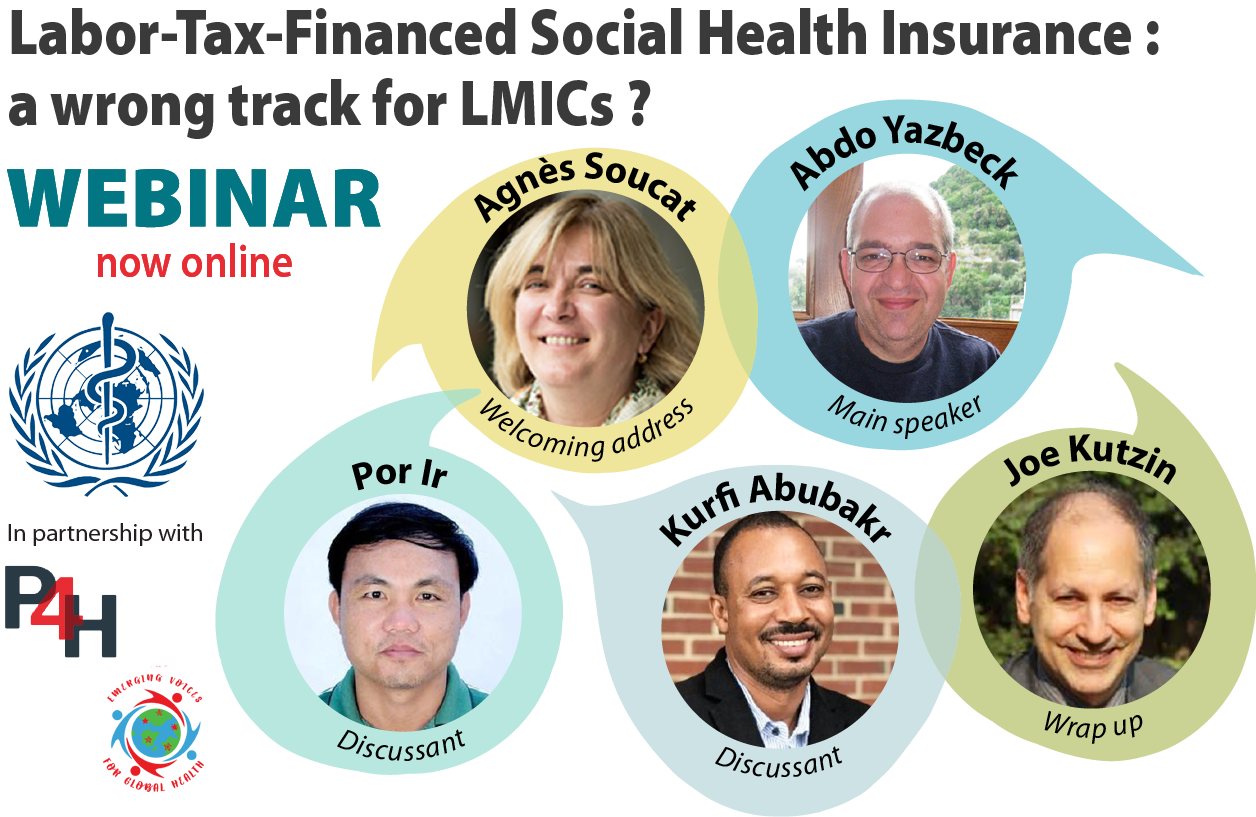

The video of the first webinar of the WHO HGF series organized in partnership with the P4H Network and Emerging Voices, “The Case Against Labor-Tax-Financed Social Health Insurance for Low- And Low-Middle-Income Countries” is now available!

In low and low-middle-income countries, there is increasing interest in initiating and expanding social health insurance through labor taxes. Yet, this vision goes against available empirical evidence. This webinar session, organized on September 24th 2020, built on recent recommendations by leading health financing experts against labor-tax financing of health care in LMICs. Message by Abdo Yazbeck and colleagues is very clear: access to health care should not be conditional to employment status. While the social health insurance model has strengths (in terms of governance for instance), it has inherent drawbacks.

MISSED THE WEBINAR? WATCH IT HERE

This session was the first of a new WHO webinar series focused on health financing and governance. If you had registered, you will be informed of the next sessions through our newsletter. If not, click here to register and tell us more about your areas of interest !

Extra reading on this topic:

- The Case Against Labor-Tax-Financed Social Health Insurance For Low- And Low-Middle-Income Countries

- Four reasons why labor taxes are not a good way to finance healthcare in low- and middle-income countries

- “Bismarck’s Miraculous and Unfortunate Re-emergence”

- Going Universal

- Can low- and middle income countries increase domestic fiscal space for health: a mixed methods approach to assess possible sources of expansion.

- Assessing fiscal space for health in the SDG era: a different story

- Is there a case for social insurance? Health Policy Plan

- Social health insurance reexamined

- Kenya National Hospital Insurance Fund reforms: implications and lessons for universal health coverage