Universal health coverage (UHC) is central to the global commitment to ensure that all people can access quality health services without financial hardship, as articulated in the Sustainable Development Goals (SDGs) with a target date of 2030. As this deadline...

APEC advances collaborative agenda to close women’s health financing gaps

APEC economies are strengthening cross-sector collaboration to close women’s health financing gaps, shaping a new regional framework to expand access to essential services through innovative financing.APEC economies are intensifying efforts to address persistent...

Avoidable pitfalls on the path to health financing self-reliance in low-income and middle-income countries

Published by BMJ Global Health, a journal of the BMJ Publishing Group, the commentary examines the policy risks facing health systems as external donor funding declines. Authored by Edwine Barasa, Jane Chuma, Justice Nonvignon, and Olusoji O. Adeyi, the article...

G20 endorses the Lusaka agenda for global health reform

The G20’s reference to the Lusaka Agenda signals growing global momentum for integrated, country-led health systems, but sustained action and investment are urgently needed, say Stine Håheim & Usman Mushtaq in Health Policy Watch.Health Policy Watch reports that...

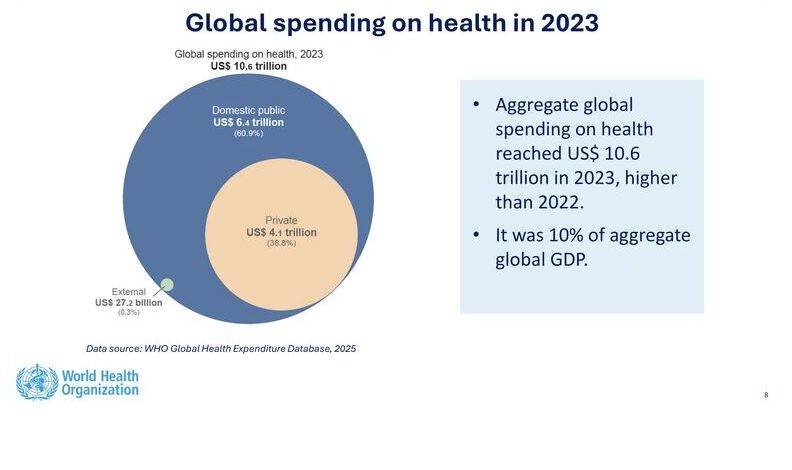

WHO releases 2025 update of the global health expenditure database

WHO has released updated health expenditure data for 190+ countries, including new visual dashboards and technical resources, covering spending trends from 2000–2023.The World Health Organization has officially launched the 2025 update of the Global Health Expenditure...

At a crossroads: Prospects for government health financing amidst declining aid

The World Bank’s report delivers an assessment of how low- and lower-middle-income countries are struggling to fund universal health coverage (UHC) as economic uncertainty deepens and development assistance declines. Part of the annual Government Resources and...

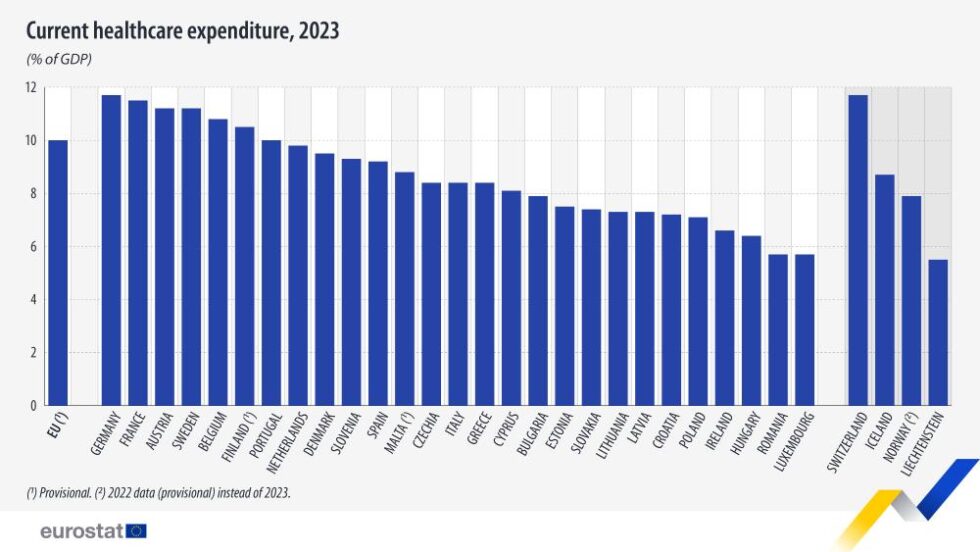

New data highlights wide gaps in EU health expenditure

EU healthcare spending reached €1.72 trillion in 2023 (10% of GDP). Germany led in total and share of GDP, while per-capita spending rose across all countries, with Romania seeing the fastest growth.Eurostat data released on November 2025 shows that healthcare...

Time to fully account for cost in monitoring financial protection and universal health coverage in low- and middle-income settings

This commentary, Time to Fully Account for Cost in Monitoring Financial Protection and Universal Health Coverage in Low- and Middle-Income Settings, published in Health Policy and Planning (18 November 2025) by Peter Binyaruka and Josephine Borghi, challenges current...

What can a ministry of finance do to improve health spending?

This ODI research report, What can a ministry of finance do to improve health spending? explores how governments—particularly in low- and lower-middle-income countries—can strengthen the efficiency and impact of health expenditure despite severe fiscal constraints....

Time to fully account for cost in monitoring financial protection and universal health coverage in low- and middle-income settings

This commentary, Beyond cost-effectiveness: a reflective commentary on adapting global health technology assessment for equity considerations in South Africa and other LMICs, published in the International Journal for Equity in Health on 14 November 2025, examines the...

Closing the deal: Financing our security against pandemic threats

The G20 High Level Independent Panel on Financing the Global Commons for Pandemic Preparedness and Response, reconvened by the South African G20 Presidency, has released a new report titled Closing the Deal: Financing Our Security Against Pandemic Threats. The report...

Experts warn global funding cuts threaten progress in reproductive health

Experts at the Family Planning 2030 conference warned that global aid cuts, led by the U.S., threaten decades of progress in reproductive health and access to contraception worldwide. At the International Conference on Family Planning in Bogotá, experts warned that...

The nexus of adaptation and health finance

This adelphi briefing, The Nexus of Adaptation and Health Finance: Mapping Multilateral Climate Funds’ Investments and National Needs, examines how global adaptation finance is responding to rising health risks driven by climate change. Authored by Mathilde Wilkens...

Catalyzing solutions for equitable global access and sustainable financing for novel tuberculosis vaccines for adults and adolescents

The newly released WHO report, 'Catalyzing solutions for equitable global access and sustainable financing for novel tuberculosis vaccines for adults and adolescents', underscores the urgent need to transform the global response to tuberculosis through coordinated...

New WHO guidance to help countries navigate health financing crisis

WHO released new guidance to help countries address severe global health financing cuts, urging stronger domestic investment, efficiency, and equity to sustain essential services and progress toward UHC. The World Health Organization (WHO) has released new guidance to...