Disclaimer: This study is published by Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH, which is a WHO Collaborating Centre; it is not a publication of the World Health Organization. The Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH is responsible for the views expressed in this broshure, and the views do not necessarily represent the decisions or policies of the World Health Organization.

Conclusions and recommendations

Although both schemes are in different stages of development, they both cover a substantial proportion of the population. National Social Protection Policy Framework (NSPPF) advances NSSF as the single institute to manage both Health Equity Fund (HEF) and NSSF, in order to increase the ability to strategically purchase healthcare services. However, as this overview suggests, the ability to concurrently manage both schemes as well as strategically purchase services is impaired by a variety of factors. These are not insurmountable and can be addressed while the social health protection system develops under the governance of National Social Protection Council (NSPC).

At this stage, HEF is the most mature scheme in the evolving social health protection system, having benefited the most from technical assistance, as expressed in the fully functioning cloud-based Patient Medical Record System (PMRS) and the well-functioning, semi-autonomous Payment Certification Agency (PCA). For efficiency reasons, NSSF could make use of these existing systems as that would help streamline its operations at minimal cost. However, before this happens it would be desirable to align operations between both schemes, especially the benefit package, provider payment mechanisms and amounts, criteria for selection of providers, and referral requirements. Alternatively, these alignments can be done afterwards. Both schemes may also benefit from additional measures, such as accreditation of private healthcare service providers. These are discussed below.

The benefit package for both schemes should be based on agreed-upon, transparent process criteria, including consideration of externalities, burden of disease, cost effectiveness, cost of intervention, and equity. A basic affordable package should be guaranteed under both schemes and always be available to contracted facilities. The services to be included should of preventive, curative, rehabilitative, and palliative in nature, and similar for both schemes. The NSSF package appears to mainly promote the use of curative healthcare services, despite the fact that a large number of NSSF members are garment factory workers, the majority of whom are women of reproductive age.

The provider payment methods and amounts should also be similar for both schemes. As it currently stands, the higher fees paid by NSSF lead to “cream-skimming”, whereby NSSF-affiliated patients are likely to be prioritised over HEF beneficiaries, which undermines equitable access to healthcare services. It also requires healthcare providers to maintain different reporting systems.

HEF only contracts with public healthcare providers. While the exclusion of private providers may restrict patient choice and impose geographical access barriers, it arguably constitutes the only quality assurance measure, as only public healthcare providers are subject to quality standards and supervisory visits. An accreditation system for both public and private providers would be an initial step towards minimum quality of care standards.

In addition, the lack of a referral system for the NSSF SHI schemes impairs efficiencies and erodes the enforcement of the district-based health system. Thus, similar referral requirements to HEF should be applied to the NSSF schemes.

Acknowledments: We wish to thank Jean-Claude Hennicot for the fieldwork and drafting of the initial report on which this document is based. The assessment was jointly designed by GIZ (Bart Jacobs) and WHO (Kumanan Rasanathan and Erik Josephson). Further input on the report by Inke Mathauer, Aurelie Klein, Fahdi Dkhimi, Maria-Lucia Nikoloudi, Julius Murke and Christian Popescu is acknowledged.

The published study was jointly funded by the German Federal

Ministry of Health and the German Federal Ministry for Economic Cooperation and Development.

Photo source: Pixabay.com

2.3 Towards UHC

In July 2017, RGC endorsed the National Social Protection Policy Framework 2016-2025 (NSPPF), 1, which lays out the vision for future development and governance of the country’s social protection system, including a roadmap for UHC. Following years of experimentation and piloting of various health financing interventions with the support of development partners, such as vouchers for reproductive health services, external and internal contracting, pay-for-performance, community-based health insurance, midwifery incentive schemes and HEF, NSPPF aims to develop a coherent and comprehensive approach towards social health protection and UHC. NSPPF envisions achieving UHC through:

- A social health insurance scheme for formal private employees, operated by NSSF;

- A social health insurance scheme for public employees, operated by NSSF;

- A health insurance for informal sector employees;

- HEF coverage for poor and other vulnerable groups (currently managed by MOH and PCA for the verification and certification of claims).

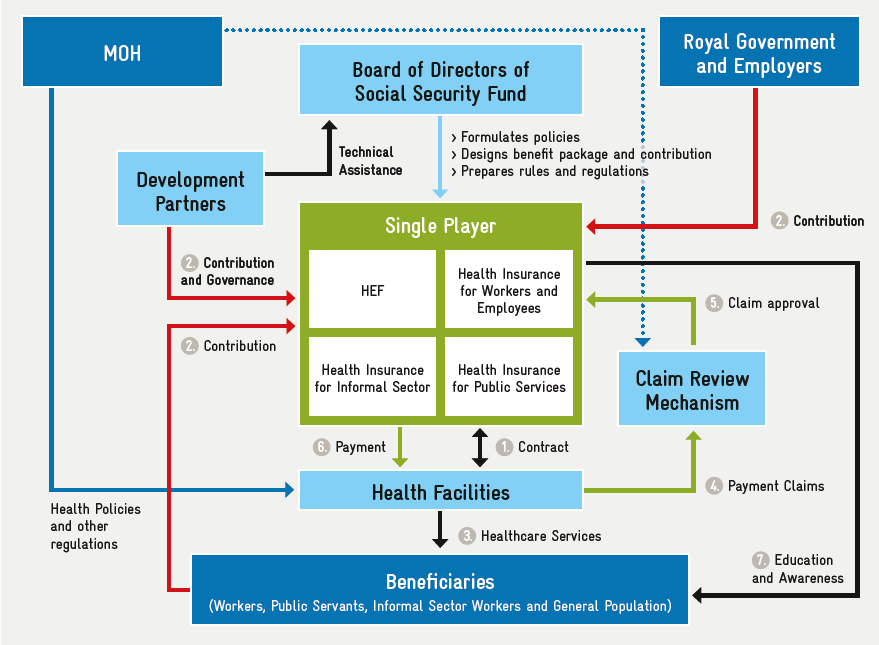

For a variety of reasons, NSPPF suggests a single operator for all three schemes (Figure 2). This operator will be supported by PCA as a semi-autonomous claim review mechanism, which will audit and approve reimbursement claims submitted to the operator.

3. Situation

3.1 Legal framework

NSSF’s SHI branch for the formal private sector is underpinned by the following legislation:

- The Social Security Law (2002) and related bylaws pertaining to the establishment of the Social Security Fund and identifying NSSF as the implementation agency;

- Sub-decree No. 01 on the Establishment of Social Security Scheme on Health Care for Persons Defined by the Provisions of the Labour Law (January 2016);

- Prakas No. 109 (Ministry of Labour and Vocational Training (MLVT)) on Health Care Benefits (April 2018);

- Prakas No. 173 (MLVT/MOH) on Provider Payment Mechanism for Health Care Benefits (August 2017);

- Sub-decree No. 140 (August 2017), stipulating the extension of NSSF to all enterprises with more one or more employees, and that SHI contributions are to be fully paid by the employer at 2.6% of insurable wages (capped at one million Cambodian riel per employee (KHR)) (USD 1 = KHR 4,000);

- Royal Decree on the Establishment of Social Security Schemes for Occupational Risk and Health Care for Public Sector Employees, Former Civil Servants, and Veterans (SN/RKT/0217/078) (February 2017), establishing work injury and SHI coverage for public employees, retired civil servants, and veterans, to be managed by NSSF;

- Joint Prakas No. 404 (MLVT, MOH, and the Ministry of Economy and Finance (MEF)) (October 2017), on coverage of informal sector workers working 8 hours per week or less, to be covered by health insurance and maternity grant (HEF extension);

- MOH Prakas (January 2018), entitling cyclo drivers to free medical care under HEF following their registration with NSSF and receipt of NSSF member card.

The social security law regarding mandatory SHI coverage for the formal (public and private) sector is being revised. The draft version addresses employment injury insurance, pensions (old age, disability, and survivorship), health insurance, cash benefits for illness and maternity, and funeral allowances. The draft law also provides for voluntary SHI coverage for informal sector workers, but does not include any provisions regarding social health protection coverage for the poor.

Discussions on the framework law governing social health protection (including social insurance and social assistance) are still ongoing.

Gaps and challenges

- The existing legal framework on social protection is rather thin, apart from the 2002 Social Security Law which currently only covers SHI for the formal private sector. The revised social security law aims to broaden this scope by including both the formal private and formal public sectors, and to extend the range of benefits by including provisions for a national pension scheme and a SHI scheme (The Social Security Law does not explicitly refer to social health insurance).

- Legal provisions on SHI for the public sector have been adopted, in the form of royal decrees, but these provisions will be integrated into the new social security law.

- There is no legislation which stipulates the entitlement of the poor to free access to health care (through HEF or otherwise).

- Although suggested in NSPPF, the draft social security law makes no reference to NSSF as the HEF operator. If this version is approved by the National Assembly it will be challenging to amend the law, and thus a separate piece of legislation (e.g., royal decree) may be required to assign the management of HEF to NSSF. However, this would exclude the possibility of cross-subsidies between funding pools, since the two funds will be covered by different pieces of legislation. It may be relevant to consider a separate law on social health insurance, which would allow the establishment of a single payer system with specific requirements.

3.2 Population coverage

SHI coverage for formal private sector workers was launched in May 2016 and – at the time of this assessment – covered about 1.3 million workers. Extension to smaller enterprises (1-7 employees) is ongoing.

SHI coverage for civil servants, public pensioners, and veterans was launched on 01 January, 2018, and covers about 315,000 individuals, including 204,083 active civil servants, 55,222 pensioners, and 54,770 veterans. The issuance of membership cards to all beneficiaries started in 2018 and is still ongoing.

Implementation of the HEF extension was initiated in January 2018 and voluntary registration is ongoing. To date, about 52,482 members have been registered and their cards have been issued. The HEF extension scheme covers informal sector workers, village chiefs, commune council members, family dependents of war veterans, and cyclo drivers.

Gaps and challenges

- The population covered by NSSF could increase to 3.2 million formal private sector employees, based on ILO estimates. However, international experience has shown that the registration of small and medium enterprises is a tedious and time-consuming process which may impede the swift extension of coverage to all formal employees.

- Dependents of formal private sector employees are not covered under SHI.

3.3 Operational issues

Registration

- NSSF is currently registering smaller enterprises (less than eight employees). Employers are identified by the Inspection Division, but registration does not follow a systematic approach to capture all licensed employers.

- Registration of individual workers remains a tedious process due to the need to collect personal information and capture biometric data (full-face photograph and fingerprints) from all workers. For many workers, this process is hampered by the lack of an ID card. NSSF works closely with the Ministry of Interior (MOI) on the issuance of ID cards for these workers at the time of their registration with NSSF. Due to the lack of adequate space at NSSF headquarters, in 2017 the registration unit was relocated to the NSSF branch office at Samroung Andeth. Registration of individual workers is likely to remain challenging due to the high rate of employee turnover, particularly in the garment sector.

- While fingerprints are collected and stored in a central database, they are not stored on the membership card issued to workers, as smart cards are considered too expensive. Health facilities currently identify eligible patients by their photographic NSSF membership card and their ID card, as well as verification with NSSF.

- Registration of public sector workers was relatively traightforward. Data on active civil servants was received from the Ministry of Civil Service, upon which individual membership cards were printed and sent to the various line ministries and public agencies for distribution to members. The cards issued to public sector workers currently do not feature a photograph. Civil servants can be identified at point of service by crosschecking their name and other personal data (e.g. date of birth) with their government-issued ID card. Pensioners and veterans were registered in the same way based on data received from the National Fund for Veterans (NFV) and National Social Security Fund for Civil Servants (NSSF-C), at MOSVY.

- HEF members are registered as they are identified and included in the IDPoor database maintained by MOP, or alternatively when seeking service at hospitals via a scorecard-based means test (post-identification).

Claims processing

Processing of claims from providers is currently proving challenging for NSSF due to the large number of claims (up to 50,000 individual patient episodes per month) and strict operating procedures which require manual processing. Per these procedures, all claims must be verified against paper records submitted by providers. This creates a considerable workload and causes delays due to the time involved in receiving and retrieving claim documents, particularly from remote provinces. The current backlog amounts to several weeks, and the delays in provider payments are reportedly around two months.

During the SHI pilot phase, NSSF developed an IT-based claims processing system referred to as the Health Social Protection Information System (HSPIS) (A pilot SHI scheme, referred to as the Health Insurance Project (HIP), was launched in 2008 by the French NGO Groupe de Recherche et d’Echanges Technologiques (GRET) and transferred to NSSF in 2011. The pilot covered around 6,000 workers in various garment factories around Phnom Penh, and was technically supported by GRET.). The system allows NSSF to check membership status and benefit eligibility of individuals, to capture benefit data (consumption) from individual members and providers, and to allow for the electronic submission of claims by providers. However, the capacity of the HSPIS platform (Microsoft Access) is limited and deemed unsuitable for upscaling to the capacity required for a national scheme. NSSF plans to develop an online system and a mobile application, allowing claims to be submitted via smart phone and to include attachments (such as scans of supporting documents).

Claim submission under HEF relies on the Patient Management Registration System (PMRS), used by all public health providers to capture utilisation data related to HEF. PMRS allows them to capture HEF membership data and detailed service records, and further allows for the preparation and submission of claims by providers.

According to information provided by NSSF’s Health Care Division, NSSF is planning to use its own IT system instead of PMRS.

Claims processing for all SHI branches managed by NSSF is currently handled internally by the Health Care Division. Healthcare providers contracted by NSSF under different branches (private or public) have to submit separate claims for each respective SHI branch.

Contracting healthcare providers

NSSF signs annual contracts with healthcare providers based on a standard contract template, reflecting the provisions stipulated in the respective regulations (benefit package, provider payment mechanism, etc.). If a provider is contracted under both the public and private sector branches, two separate contracts are signed with NSSF, although the contract provisions (benefit package and payment mechanism) are largely the same. Contracting with public providers is primarily a formality since the contract terms and provisions are laid out in the joint MOH-MLVT prakas, and public hospitals are not in a position to object to these terms.

Private healthcare providers are not bound by public sector regulations and may choose not to accept the terms offered by NSSF, in particular the proposed fees. For these fees, existing regulations stipulate an amount equal to 120-150% of the case fees payable to public providers at the same level of care. According to the regulations, the percentage applicable for every private provider is determined by NSSF after a quality assessment. In practice, however, all providers are currently paid 150% of the case fees applicable for public facilities of the same level (complementary package of activities level 1 (CPA1), CPA2, CPA3, or national hospital (NH)).(Based on information provided by Mr Sophannarith Heng, Director of NSSF Policy Division).

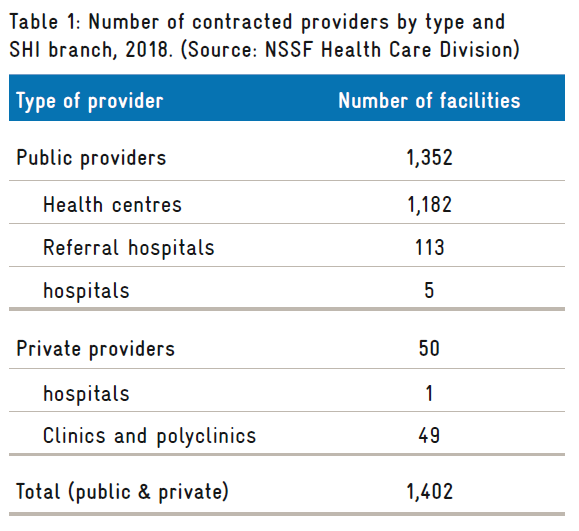

By the end of 2018, NSSF had contracted a total of 1,402 facilities, including 49 private clinics and polyclinics, and one private hospital (Table 1).

The decision to contract with private providers is reportedly justified by scheme members’ preference to seek care at private facilities. For outpatient services in particular, most insured members have a preference for private providers due to the perceived increase in service quality.

The selection of private providers contracted by NSSF is based on requests by employers, who submit a formal request to NSSF to contract a specific private healthcare provider in the vicinity of the employer’s facilities (e.g., close to their garment factory) in order to limit the time off work and ensure convenience for employees when accessing healthcare services. Upon receiving this request, the Health Care Division undertakes an assessment of the respective facility to classify it according to the available service package (CPA1, CPA2, CPA3, or NH), based on MOH regulations applicable to public providers.

Contrary to HEF, NSSF has no gatekeeping system, such as a referral system for inpatient services. The free choice of a service provider aims to ensure maximum convenience for insured members, who may prefer seeking care from a nearby healthcare facility. The absence of a referral system, however, has profound implications in terms of care-seeking behaviour, patient burden at tertiary hospitals, and cost effectiveness of the scheme. It has been reported that some public providers (in particular Calmette National Hospital) are already overburdened, and cannot cope with the additional volume of patients accessing services through NSSF.

In the absence of a strict regulatory framework for private hospitals and the lack of a hospital accreditation mechanism, there is concern regarding quality of care and regulatory supervision of private providers. Furthermore, since private providers are paid more for the same types of service, without an assessment of the actual costs, the contracting of private providers may affect cost effectiveness, and could undermine the financial sustainability of the scheme in the future.

Benefit package

The medical benefit package covered under NSSF’s private sector branch is defined in Prakas No. 184 on Health Care Benefits (amended 25 April 2018), and includes medical benefits (in kind) and income replacement benefits (in cash) during absences from work due to illness or maternity. The medical benefit package includes all services available at public hospitals, except for:

- Services covered under vertical health programmes;

- Dental care;

- Sex change operations and care;

- Organ transplants;

- Artificial insemination;

- Self-treatment;

- Plastic surgery;

- Artificial vision devices and laser vision surgery;

- Treatments for drug abuse;

- Infertility treatment;

- Eye implant surgery;

- Coronary and heart surgery;

- Hemodialysis;

- General health check-ups.

Reimbursement of drug costs is limited to pharmaceuticals included on the essential drug list as published by MOH.

The medical benefit package for the public sector scheme is the same as for the private sector, and references the same prakas.

For HEF, the benefit package is defined in MOH’s Guidelines for the Benefit package and Provider Payment of the Health Equity Fund for the Poor, 2018, and includes medical benefits (in kind) and cash allowances (reimbursement of transportation costs, food allowance during admission, and funeral benefits). The medical benefit package for HEF patients includes the full range of services defined in the Clinical Practice Guidelines, according to the level of the facility. All services provided by individual health facilities are available for free at the point of delivery to HEF beneficiaries. Excluded services include:

- Select treatments for cancer;

- Organ transplants;

- Cosmetic surgery for the purpose of improving a person’s appearance and/or removing signs of tattoos;

- Infertility treatments;

- Medications not included in the MOH essential drug list.

The differences between the two exclusion lists suggest that:

- Chemotherapy and radiation cancer therapy is covered by NSSF but not by HEF;

- NSSF explicitly excludes dental care, eye surgery, heart surgery, and hemodialysis, whereas HEF does not explicitly exclude these services.

As mentioned, HEF applies a strict referral system, while NSSF allows its members to seek care at any facility of their choosing, including national hospitals.

3.4 Provider payment mechanisms

Both NSSF and HEF use case-based PPMs, but case definitions and reimbursement rates differ. NSSF applies exactly the same rates and case definitions to both the private and public sector branches. […] Case definitions and associated amounts vary considerably between the two schemes. For a normal delivery at a national hospital, NSSF reimburses the provider KHR 400,000 per case versus KHR 100,000 provided by HEF. NSSF increased provider payment rates in August 2017, after receiving complaints by facilities that the initial rates were too low. However, these increases were introduced without an assessment of the actual costs of services.

Since the risk of over-reporting cannot be excluded, some form of verification is required to discourage fraudulent behaviour by providers. NSSF requires that all claims are supported by medical records for each illness episode. These are to be certified by the local NSSF office before submission to NSSF headquarters for processing and reimbursement.

NSSF has established a 15-member Provider Payment Mechanism Committee, including members from NSSF (which serves as the committee chair), the National Institute of Public Health, the MOH Hospital Department, and a public hospital representative (currently, Kossamak Hospital). The private sector is not formally represented. The committee agrees on the proposed provider payment mechanism (PPM) rates before submission to the NSSF Board of Directors for approval. Committee members are both purchasers and providers, hence any negotiations about NSSF reimbursement rates take place within this committee.

3.5 Concurrent management of schemes

NSSF currently manages the private sector scheme, the public sector scheme, and the HEF extension scheme. Regarding the latter, NSSF only takes care of member registration, issuance of membership cards, and the payment of maternity grants to pregnant women. Medical benefits under the HEF extension scheme are managed directly by HEF.

The concurrent management of medical benefits under the SHI branches for the private and public sectors does not cause major problems for NSSF, as the two schemes use the same benefit package and provider payment rates. While the rapid roll-out of the public sector scheme has added to the already heavy workload, especially in terms of claims processing, it did not seem to cause other problems given that work processes and operating procedures are basically the same and are handled by the same divisions.

Operational differences between the two schemes (private and public) relate mainly to the registration and the collection of contributions. SHI contributions in the public sector branch are remitted in bulk directly by MEF, and the registration process for the public sector was based on beneficiary data provided by Ministry of Civil Services (active employees) and MOSVY (pensioners and veterans). As the rate of employee turnover in the public sector is low, updating the membership database is not a major issue.

The concurrent management of HEF may prove more challenging because of differences in certain aspects, mainly related to the benefit package and PPM. As HEF has existed for many years, its work processes are already streamlined and may be challenging to harmonise with those of NSSF. Another possible issue is the transfer of responsibilities (governance policy, purchasing, financing, etc.) and allocation to entities within NSSF.

The registration of HEF members by NSSF on the basis of data included in the IDPoor database could be relatively straightforward.(It can be assumed that IDPoor will remain at MOP, since they have the institutional capacity to carry out the means testing at the local level. Furthermore, the data on poor households may be required by other line ministries (e.g., MOSVY) for the targeting of other social assistance benefits). NSSF could print HEF membership cards based on the provided data, and distribute the cards to identified households via the MOP departments in each province. Alternatively, HEF member households could be required to pick up their cards at the nearest NSSF branch office, where biometric information could also be collected. However, this latter option may impose a financial burden on impoverished households.

3.6 Quality assurance

Public healthcare facilities operate under the authority of MOH, with the Department of Hospital Services responsible for ensuring quality of care. However, in the absence of patient records at such facilities, the quality of care provided to patients is difficult to measure or assess.

The NSSF benefit package lacks details about the quality of care. NSSF runs a hotline service to deal with member inquiries and complaints, but this is unlikely to include technical aspects of service quality. When NSSF receives complaints about healthcare services from members, its healthcare division contacts MOH to investigate the case. While the hotline ensures some level of accountability for contracted providers, it does not deal with technical quality of care issues in a comprehensive manner.

HEF takes a more proactive approach to quality of care, in the broader context of H-EQIP, with specific interventions aimed at promoting and monitoring service quality at public facilities, including using quality scores to allocate perform-based financing incentives.(In addition to block grants paid to all public facilities, the government is also introducing the allocation of performance grants based on a detailed quality monitoring system).

Quality assurance is a major issue when contracting private providers because of the weak regulatory framework for private healthcare facilities and the absence of an official accreditation mechanism. According to the regulations for NSSF provider payments (Prakas No. 173, MLVT), payment rates for private providers can be adjusted according to the facility’s quality standards as assessed by NSSF. However, it is not known if NSSF has the capacity to comprehensively deal with this issue.

3.7 Governance

NSSF is governed by a tripartite Board of Directors, comprising representatives of employers (employer federations), employees (trade unions), and the government (MEF, MOH, and MLVT which serves as the chair). The composition of the board was extended for the public sector scheme to also include representatives from NSSF-C, NFV, and the Fund for People with Disabilities (PWDF). The role of the board is to exercise oversight over NSSF operations and to endorse decisions proposed by the Executive Director, in particular on financial issues. The board convenes on a monthly basis and only deals with major decisions (e.g., annual operating budget plans).

Technical matters are handled by the executive management of NSSF, including the directors of the various NSSF divisions (policy, registration, benefits, health care, accounting/finance, IT, etc.). Decisions regarding SHI are primarily under the authority of the director of the health care division. For matters related to provider payment rates, NSSF has established a Committee on Provider Payment Mechanisms, comprising 15 members from NSSF (the chair), the National Institute of Public Health, the MOH Department of Hospital Services, and representatives from public hospitals (Kossamak Hospital, etc). The committee agrees on the proposed provider payment rates before submission to the NSSF Board of Directors for approval. It is noted that the committee members are not necessarily free from conflicts of interest, as they are also purchasers and providers.

For HEF, governance authority rests in principle with the health financing steering committees (HFSC) established at the provincial and district levels, which are chaired by the vice-governors in those areas. In Phnom Penh, the HFSC is the final referral point for any decisions or problems that can’t be solved at a lower level. HEF operates under the executive authority of MOH, where authority is shared between the Department of Planning and Health Information (DPHI), which is in charge of the benefit package and PPM, and the Department of Budget and Finance, which handles financial matters. A semi-autonomous PCA has been established to verify and audit claims received from all public healthcare facilities.

The National Social Protection Council (NSPC) was established in 2017 and is expected to assume the role of overarching governance body for the social protection system, to oversee policy formulation and implementation. NSPC is chaired by MEF and comprises the ministers of the concerned line ministries (including MOSVY, MLVT, MOH, the Council for Agricultural and Rural Development (CARD), the Ministry of Education, Youth and Sport (MOEYS), and others) (Royal Decree on the Establishment of the National Social Protection Council (2017). An executive committee, acting as the Secretariat of the NSPC, was also established in 2017 and convenes regularly to discuss social protection policy issues.

According to the relevant sub-decree, NSPC will establish additional technical committees, sub-committees, and technical working groups to deal with the technical aspects of policy formulation and implementation monitoring. The governance of strategic purchasing policy on a national level would normally fall under the authority of the relevant NSPC sub-committee, but it is still unclear if or when such a committee would be established.

3.8 Financing

NSSF is a mandatory social insurance scheme financed by payroll contributions levied at the source (i.e., from employers). The contribution rate for SHI is fixed at 2.6% of insurable earnings to cover medical and income replacement benefits in case of absence from work due to illness or maternity. In 2017, contribution income from the private sector SHI branch of totalled USD 38.7 million, whereas total benefit expenditures were USD 6.6 million, including USD 3.6 million for medical care. Medical benefit expenditures per capita in 2017 were only USD 3.05, but are expected to increase due to increasing utilisation.

The contribution rate for the public sector SHI scheme is fixed at 1.0% of public sector wage costs, and only covers medical benefits. The contributions for pensioners and veterans are fully subsidised by the government.

HEF is a non-contributory social health protection scheme jointly financed by RGC and development partners. HEF is technically supported by H-EQIP (from 2016 – 2021) and funded by RGC (USD 95 million) with support from KfW, the World Bank, DFAT, and KOICA. Currently, these development partners contribute around USD 6 million to HEF annually. In 2017, medical benefit expenditures under HEF totalled USD 6.5 million, or about USD 2.60 per person per year (Figures reported by Keo Lundy, GIZ consultant; see Implementation Status Analysis, Social Health Protection (2018). Official data on HEF could not be made available.).

NSPPF suggests the future establishment of a single health insurance pool for all SHI schemes, allowing for cross-subsidisation between different population groups (formal sector, the poor, informal workers, etc.).

1. Background and objectives

This blog presents the findings from an assessment of the co-management of different social health insurance (SHI) schemes by the Cambodian National Social Security Fund (NSSF), with a focus on the strategic purchasing of health services from public and private health providers in Cambodia. The assessment was conducted between January and March 2019 within the role of Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) as a World Health Organization (WHO) collaborating centre for health system strengthening and health financing for universal health coverage (UHC). All information was obtained through key informant interviews and a desk review of relevant documentation.

The objective of this study is to provide recommendations for approaches that will enable a smooth transition of the managerial authority of health equity funds (HEF) from the Ministry of Health (MOH) to NSSF as envisaged in the National Social Security Planning Framework (2016-25).

2. Context

2.1 Social health insurance

NSSF was established in 2008 based on the provisions of the Social Security Law adopted by the National Assembly in 2002. The scheme started providing employment injury and occupational disease benefits to private sector workers in 2009, with a social health insurance (SHI) branch being considered since 2010. In 2013, a ministerial regulation (prakas in Khmer) was adopted, stipulating the establishment of the NSSF Health Insurance Division. In January 2016, the Council of Ministers adopted a sub-decree stipulating the establishment of a health insurance branch of NSSF, which was subsequently launched in October 2016 (Sub-decree on ‘Establishment and Implementation of a health insurance scheme for persons defined by the provisions of the labour law’.). Under this scheme, the benefit provisions for formal private sector workers include both medical (in-kind) benefits and income replacement (cash) benefits payable in the event of absence from work due to maternity or illness.

In 2017, the Royal Government of Cambodia (RGC) adopted a Royal Decree on the introduction of employment injury and SHI benefits for employees in the public sector, which also covered retired public officials and veterans, but not their dependents. According to this decree, NSSF was mandated to administer the public sector SHI scheme in addition to the scheme for employees in the private sector. SHI for the public sector was launched nationally in January 2018. The scheme is financed from payroll contributions paid by the government and fixed (by prakas) at 1% of public employee wages.

2.2 Health equity funds

Health equity funds (HEF) are non-contributory social health protection schemes reimbursing providers for costs incurred by poor people seeking services at public healthcare facilities. They also aim to reduce direct non-medical costs of care-seeking by providing food stipends and reimbursing transportation costs for hospitalised beneficiaries and caretakers. HEFs were initially piloted by development partners, mainly NGOs, but have been consolidated, institutionalised and expanded nationwide since 2015. The national HEF program is operated by the Ministry of Health and technically and financially supported by the Health Equity and Quality Improvement Program (H-EQIP, 2016 – 2021), which is jointly funded by RGC (USD 95 million), the German development bank KfW, the World Bank, the Australian Department of Foreign Affairs and Trade (DFAT), and the Korea International Cooperation Agency (KOICA). HEF covers about 2.5 million people in Cambodia. Beneficiaries are identified through a nationwide exercise under the Ministry of Planning (MOP) using community-based proxy means testing at three-year intervals.

In addition, post-identification screenings are available at hospitals to capture qualilfied individuals missed during the pre-identification process. Food stipends and transport reimbursements are only for beneficiaries admitted to inpatient departments (IPDs) who have been referred from a public health centre, or directly admitted in delivery or emergency cases. While HEF focuses on poor households, coverage for other vulnerable households, such as those with older people, people with disabilities, and children under five, is currently under consideration.

In 2016, a third-party payment certification agency (PCA) was established to certify claims submitted to HEF from providers, and to ensure financial accountability.

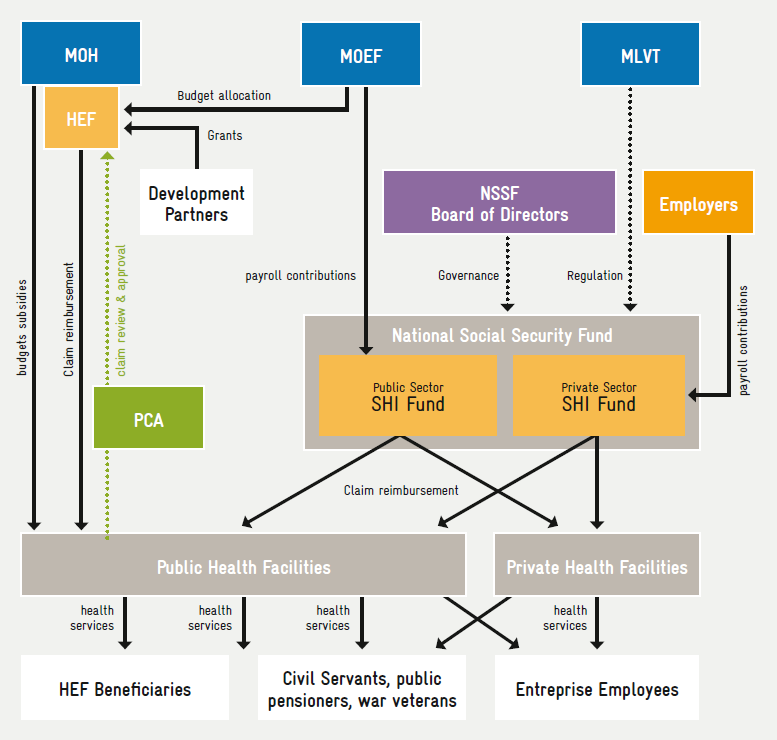

The current set-up of the national health protection system is pictured in Figure 1. […]

4. Strategic purchasing potential under current arrangements

This assessment uses the definition of strategic purchasing put forward by Klasa et al (2019): “To make purchasing strategic, purchasers should incorporate issues such as population needs, quality, evidence, efficiency, and a concern for equity and population health. Strategic purchasing makes demands on all of the various components of the purchasing function, including citizens, purchasers, providers, regulators, and governments” (Klasa et al., 2018). Strategic Purchasing in Practice: Comparing Ten European Countries. Health Policy, 122: 457-72.). Or in other words, “strategic purchasing involves a continuous search for the best ways to maximise health system performance by deciding which interventions should be purchased, how, and from whom” (World Health Report, Geneva (2000).

Mathauer, Dale and Meessen (2017) identified five key themes that are critical to strategic purchasing in a country, which are detailed in the subsections below (Mathauer I, Dale E, Meessen B., 2017, Strategic purchasing for universal health coverage: key policy issues and questions. A summary from expert and practitioners’ discussions. Geneva: World Health Organization).

4.1 Governance arrangements

Governance arrangements refers to “ensuring that strategic policy frameworks exist and are combined with effective oversight, coalition-building, regulation, attention to system-design and accountability”.

Governance is ensured by NSPC, which has matured since its recent inception. The NSPPF outlines the arrangements for a single purchaser under NSSF. The recently endorsed Law on Social Security, mainly formulated by MLVT –which NSSF is attached to – does not mention HEF, whereby it is not clear how this single purchaser will function. The private healthcare sector has no representative body, making communication challenging. Apart from registration, little control over this sector’s practices is exerted.

4.2 Information management

Information management implies that “funds going to providers are based on information on performance aspects or on population health needs”.

In this case, both schemes have parallel information collection systems. NSSF has introduced an IT-based system, which is limited in its range and capacities. For HEF, information is collected by the semi-autonomous PCA through PMRS, which is operational at all public healthcare facilities. Only information on the provided services is collected, and the information available does not allow the quality of care to be assessed.

Standard treatment guidelines are in place, but there are no mechanisms to verify their application. Both schemes do not promote efficiency or quality of care. Patient dossiers, against which the delivered healthcare services could be verified, are not in place and thus services cannot be purchased in accordance with pre-defined standards of care. Instead, the verification system consists of minimising fraud by interviewing a predetermined number of beneficiaries to ask if they received effective healthcare services.

4.3 Benefit package design

Benefit package design refers to “those services that are to be paid, in part or in full, by the purchaser from pooled funds, with a focus on their price instead of on the costing of the benefit package while optimising alignment of the benefit package and provider payment and methods”.

Both schemes have different benefit packages, PPMs, and payment rates […]. In practice both use case-based payments, although NSSF tends to supplement these, especially at national hospitals, with fees for selected services. These fees have been negotiated on an individual basis with each facility and are not necessarily the same for facilities at the same level. The last costing exercise to determine user fees was conducted in 2011 at 10 non-national hospitals of various levels (Martin A. (2012). Cambodia hospital costing and financial management study. Phnom Penh: Ministry of Health). More recent estimates from 2016 and 2017 are available for 60 healthcare facilities (including 17 hospitals, but excluding all national hospitals), but are not yet in use.

The benefit package is very comprehensive with exclusion of several high-cost interventions. In practice the package is limited to what is available whereby in practice there is insufficient provision of services for secondary prevention of non-communicable diseases and geriatric and palliative services.

As mentioned previously, the information that NSSF (and HEF) use to calculate service provision fees is dated. In addition, HEF user fees are not based on cost estimations. This is partly because user fees for public healthcare services are nominal, and mainly intended as an incentive for staff members. As such, up to 60% of these fees are allocated for staff incentives. This practice of incentivising staff members hampers reimbursing actual costs, however, as these then need to be inflated by 60%. Another issue with purchasing is the fact that 80%-90% of the income of concerned facilities consists of salaries and in-kind supplies, limiting their own ability to incentivise staff.

While a substantial number of NSSF members are garment factory workers, the majority of which are women of reproductive age, insufficient attention appears to be paid to their related health needs. For example, while use of hospital services is stimulated in the absence of a referral system, contraceptives are only reimbursed when they are provided at health centres. HEF, on the other hand, incentivises healthcare providers at all levels to deliver contraceptive services, especially long-lasting methods. Unlike NSSF, HEF also encourages healthcare providers to screen for breast cancer and cervical cancer, and promotes screening for impairments among newborns and children 1-5 years old.

4.4 Mixed provider payment systems

Mixed provider payment systems refers to “not only addressing individual provider payment challenges but employing a system perspective that looks at all provider payment methods jointly”.

Drugs and consumables are free of charge and centrally supplied to public healthcare facilities through the Central Medical Stores. Shortages in supplies are to be covered by the 40% of user fees that is not allocate to staff incentives (for which the other 60% of user fees is used for). When treating noncommunicable diseases, for which supplies are insufficient, costs are generally shifted to patients, who respond by seeking care in the private sector. While NSSF applies different rates for private healthcare providers than for public ones, they are arbitrarily set at 150% of public sector fees. The additional payments are supposed to cover salaries, equipment, and capital costs, for which private providers do not receive additional allocations. However, no cost analysis has been done to justify the 150% valuation.

Employing user fees has detrimental effects on enforcing the primary care system, as well as the equitable provision of healthcare services, especially in remote and challenging environments. Health centres, as frontline providers for primary care, mainly deliver preventive healthcare services at very low cost, minimising potential income and thus staff remuneration. NSSF does not enforce a referral system, and thus patients bypass the primary level for services from secondary and tertiary hospitals. This in turn minimises the income for health centres and imposes high costs to NSSF, as higher-level services are considerably more expensive. Challenges in generating money from user fees, the principal incentive for staff, impairs the ability of health centres to attract qualified healthcare providers, especially in underserved areas.

4.5 Managing alignment and dynamics

Managing alignment and dynamics implies that “particular focus needs to be put on the continuous adaptation of the benefit package and the provider payment system including both payment methods and complementary administrative mechanisms, as a way to respond to provider behaviour caused by provider payment methods themselves”.

As indicated above, the services excluded from the benefit package between the two schemes differ slightly and relate to high costs or service coverage (e.g., plastic surgery). They are not based on a rigorous cost-effectiveness or cost-benefit assessment. On the other hand, both benefit packages include services which the public healthcare sector is not able to properly provide, such as management of noncommunicable diseases (Jacobs B, Hill P, Bigdeli M, Men C. (2016). Managing non-communicable diseases at health district level in Cambodia: a systems analysis and suggestions for improvement. BMC Health Services Research, 16 (32)).

Both schemes employ different administrative procedures; procedures for HEF are more advanced in terms of digitalisation, speed, and accuracy. The higher fees paid by NSSF […] are likely reinforcing inequitable treatment of patients associated with the latter scheme. Contrary to NSSF, HEF doesn’t pay for hospitalisation of tuberculosis cases, and instead promotes ambulatory care in line with international practices.

- Royal Government of Cambodia. (2017). National Social Protection Policy Framework (NSPPF[↩]