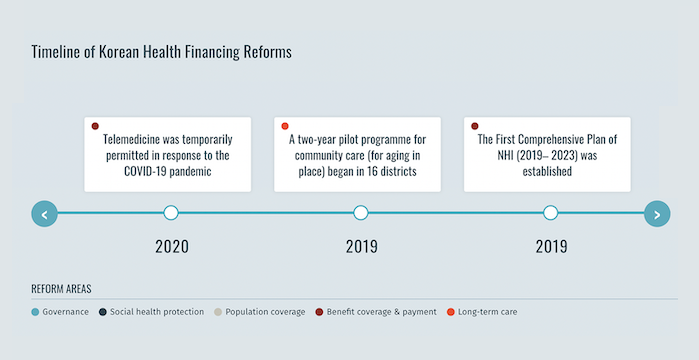

La República de Corea alcanzó sus objetivos de cobertura sanitaria universal en 1989, sólo 12 años después de que el gobierno introdujera el Seguro Nacional de Salud (SNS) obligatorio en 1977.[1] Durante este periodo, la afiliación al NHI se amplió progresivamente a toda la población, empezando por las empresas con 500 o más empleados. Además, el Programa de Ayuda Médica (MAP), un programa de asistencia a los pobres financiado con impuestos y establecido en 1979, sigue vigente a partir de 2024. En 2000, los regímenes de seguros anteriormente descentralizados se fusionaron en un sistema de pagador único con dos organizaciones casi públicas: el Servicio Nacional del Seguro de Enfermedad, que recauda las primas y reembolsa a los proveedores, y el Servicio de Revisión y Evaluación del Seguro de Enfermedad, que revisa las reclamaciones y garantiza la calidad[2] Aunque el sistema sanitario consigue unos resultados sanitarios que superan la media de la Organización para la Cooperación y el Desarrollo Económico, el grado de protección financiera sigue siendo preocupante, dada la elevada carga de gastos de bolsillo en la República de Corea. En 2019, el gobierno del país puso en marcha una reforma del SNS en el marco del Plan Integral del Seguro Nacional de Salud (2019-2023 ) para ampliar el índice de cobertura del SNS al 70% de los gastos médicos para 2023.

Adopción proactiva del seguro universal de dependencia

Preparación para la protección sociosanitaria durante la pandemia de COVID-19

Antes de la pandemia de COVID-19, la República de Corea sufrió un brote del Síndrome Respiratorio de Oriente Medio. Tras este brote, las reformas legislativas y normativas reforzaron los sistemas de preparación y respuesta ante emergencias de salud pública del país. Por lo tanto, cuando la pandemia de COVID-19 golpeó el país, el NHI respondió rápidamente. El NHI incluyó pruebas y medicamentos relacionados con el COVID-19 en el paquete de prestaciones y adoptó medidas de ayuda de emergencia. Estas medidas incluían el descuento de la cotización al NHI para las personas gravemente afectadas por el COVID-19 y la provisión de fondos de ayuda a particulares y empresas. El NHI garantizó el acceso de las personas a las pruebas y el tratamiento sin barreras financieras, en línea con la cobertura sanitaria universal de la República de Corea para toda su población.[5]

References

- Ampliación de la Protección Social Sanitaria: Acelerar el progreso hacia la cobertura sanitaria universal en Asia y el Pacífico. Organización Internacional del Trabajo, 2021

- Kwon, Soonman, et al. República de Corea: Revisión del sistema sanitario. 5:4(Organización Mundial de la Salud, 2015

- Kim, Hongsoo, y Soonman Kwon. “Una década de seguro público de cuidados de larga duración en Corea del Sur: Lecciones políticas para los países que envejecen“. Política Sanitaria, vol. 125, nº 1, enero de 2021, pp. 22-26. ScienceDirect

- Gobierno de Corea, comunicado de prensa del Ministerio de Sanidad y Bienestar Social. 2023. Consultado el 8 Abr. 2024

- Kwon, Soonman, et al. “Republic of Korea’s COVID-19 Preparedness and Response”. Serie de Notas sobre Innovación y Tecnología de la Oficina de Corea del Grupo del Banco Mundial, nº. 3, 2020