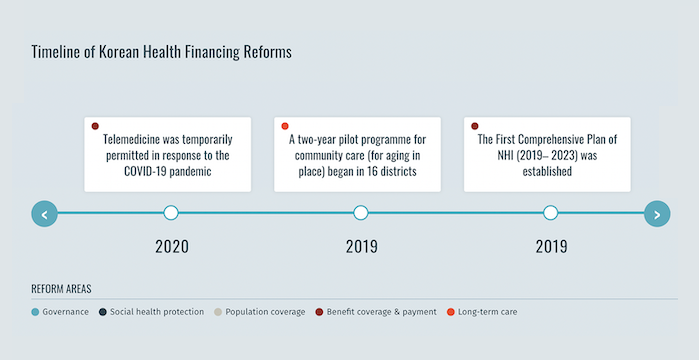

La République de Corée a atteint ses objectifs en matière de couverture sanitaire universelle en 1989, 12 ans seulement après que le gouvernement ait introduit l’assurance maladie nationale obligatoire (NHI) en 1977.1 Au cours de cette période, l’affiliation au NHI a été progressivement étendue à l’ensemble de la population, en commençant par les entreprises de 500 salariés ou plus. En outre, le Medical Aid Program (MAP), un programme d’aide aux pauvres financé par l’impôt et créé en 1979, restera en place jusqu’en 2024. En 2000, les régimes d’assurance précédemment décentralisés ont été fusionnés en un système à payeur unique avec deux organisations quasi-publiques – le Service national d’assurance maladie, qui collecte les primes et rembourse les prestataires, et le Service d’examen et d’évaluation de l’assurance maladie, qui examine les demandes de remboursement et fournit une assurance qualité.2 Bien que le système de santé obtienne des résultats supérieurs à la moyenne de l’Organisation de coopération et de développement économiques, le degré de protection financière reste préoccupant compte tenu du poids élevé des frais à la charge du patient en République de Corée. En 2019, le gouvernement du pays a mis en œuvre une réforme de l’assurance maladie nationale dans le cadre du Plan national global d’assurance maladie (2019-2023 ) afin d’étendre le taux de couverture de l’assurance maladie nationale à 70 % des dépenses médicales d’ici 2023.

Adoption proactive d'une assurance universelle pour les soins de longue durée

Préparation à la protection sociale de la santé pendant la pandémie de COVID-19

Avant la pandémie de COVID-19, la République de Corée a connu une épidémie de syndrome respiratoire du Moyen-Orient. À la suite de cette épidémie, des réformes législatives et réglementaires ont renforcé les systèmes de préparation et de réponse aux urgences de santé publique du pays. Par conséquent, lorsque la pandémie de COVID-19 a frappé le pays, l’INSA a réagi rapidement. Le NHI a inclus les tests et les médicaments liés au COVID-19 dans l’ensemble des prestations et a adopté des mesures d’aide d’urgence. Ces mesures comprenaient une réduction de la contribution à l’INSA pour les personnes fortement touchées par le COVID-19 et l’octroi de fonds de secours aux particuliers et aux entreprises. Le NHI a permis à la population d’accéder aux tests et aux traitements sans obstacle financier, conformément à la couverture sanitaire universelle de la République de Corée pour l’ensemble de sa population.5

- Extension de la protection sociale en matière de santé : Accélérer les progrès vers la couverture sanitaire universelle en Asie et dans le Pacifique. Organisation internationale du travail, 2021 [↩]

- Kwon, Soonman, et al. République de Corée : Examen du système de santé. 5:4Organisation mondiale de la santé, 2015 [↩]

- Kim, Hongsoo, et Soonman Kwon. “A Decade of Public Long-Term Care Insurance in South Korea : Policy Lessons for Aging Countries“. Politique de santé, vol. 125, n° 1, janvier 2021, pp. 22-26. ScienceDirect [↩]

- Gouvernement de la Corée, communiqué de presse du ministère de la santé et de la protection sociale. 2023. Consulté le 8 avril 2024 [↩]

- Kwon, Soonman, et al. “Republic of Korea’s COVID-19 Preparedness and Response”. Série de notes sur l’innovation et la technologie du Bureau de la Corée du Groupe de la Banque mondiale, no. 3, 2020 [↩]